Thanks, Damien.

I don’t understand the theories involved, but I feel sure that something must happen. What it will be is up to God. Could it be the Balances being held in the hand of the one riding the Black Horse of Revelation 6?

jdc

==============

Pastor John

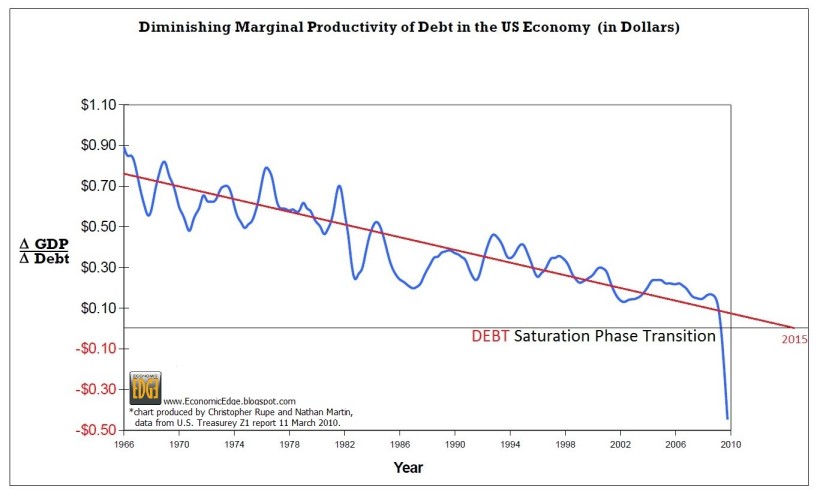

Following is a graph that is not difficult to follow. It shows the change in US GDP (Gross Domestic Product) for each extra dollar of Federal debt incurred since 1966. I’m no economist but I have learned that each dollar “created” by the Federal Reserve enters the economy as debt against the Federal government. What the graph shows is that during the last 6 months of 2009 the US economy reached the point where increasing the debt was associated with a shrinkage of the economic output of the country.

In the recent past the US government has worked on the premise that incurring debt and running budget deficits was OK because it grew the economy and thus (in theory possibly) the ability to repay. I have heard congressman in the last year say “deficits don’t matter”. Well if this graph holds true and something remarkable does not occur soon then the deficits or “stimulus” spending of “created” money, which is actually more debt incurring interest, will result in continuing and devastating implosion of the US economy. This years projected deficit of around 1.5 trillion could result in a GDP reduction of 675 billion (~5%) based on the last quarter 2009 figure of -0.45c per $ of debt. Such changes will act to rapidly increase the ratio of debt to GDP towards the levels that small countries in the news of late such as Iceland, Ireland and Greece are facing. If this continues for long at all and the Government continues to increase the debt something will surely have to give. If the US credit rating drops from AAA interest rate rises could destroy the economy even more rapidly.

Somehow I don’t anticipate this happening just yet. Maybe it will but I really rather wonder that we are going to see something really startling coming up in the next period of history. In any case this strikes me as a pivotal moment in US history. The US economy in current form can no longer presently utilize debt effectively at all. More debt is dragging it down as the repayments become too much to bear. At the same time the government is spending big and receiving diminished tax income. You and I can’t budget that way!

Graph from http://economicedge.blogspot.com/